The Economy: Is it Up? Is it Down? Where is it Headed?

Author: Ty Leitow

Last Updated: August 28, 2025

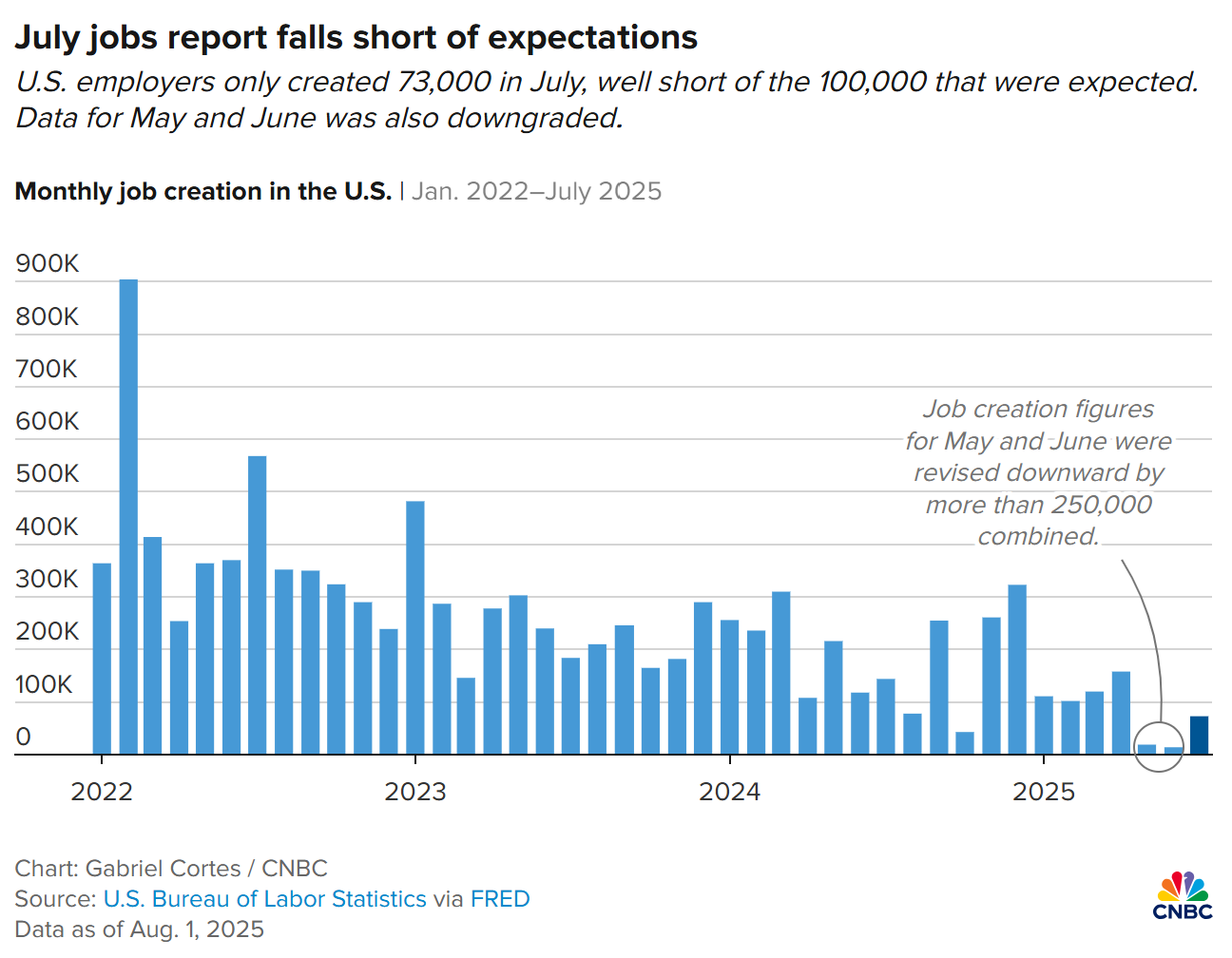

Job Market

Most economists say a healthy U.S. job market adds around 100,000 new jobs per month. In July, only 74,000 jobs were added, and over the past three months, the average has plummeted to just 35,000. Hiring appears to be flatlining.

Last Friday, Federal Reserve Chair Jerome Powell said the economy is in a “curious balance.” Both job supply and demand are weak, yet the unemployment rate remains relatively low. In June, unemployment stood at 4.1%; in July, it ticked up slightly to 4.2%. That’s still a solid number historically, but we need to remember that all these measurements look backward. We don’t know what the unemployment rate today, and if it continues to rise while new hiring slows, the job market could be cooling quickly.

Additionally, the number of people collecting unemployment benefits has been rising. As of August 9, nearly 2 million people were on unemployment—the highest level since November 2021.

Taken together, the data is pointing to a rapidly cooling job market.

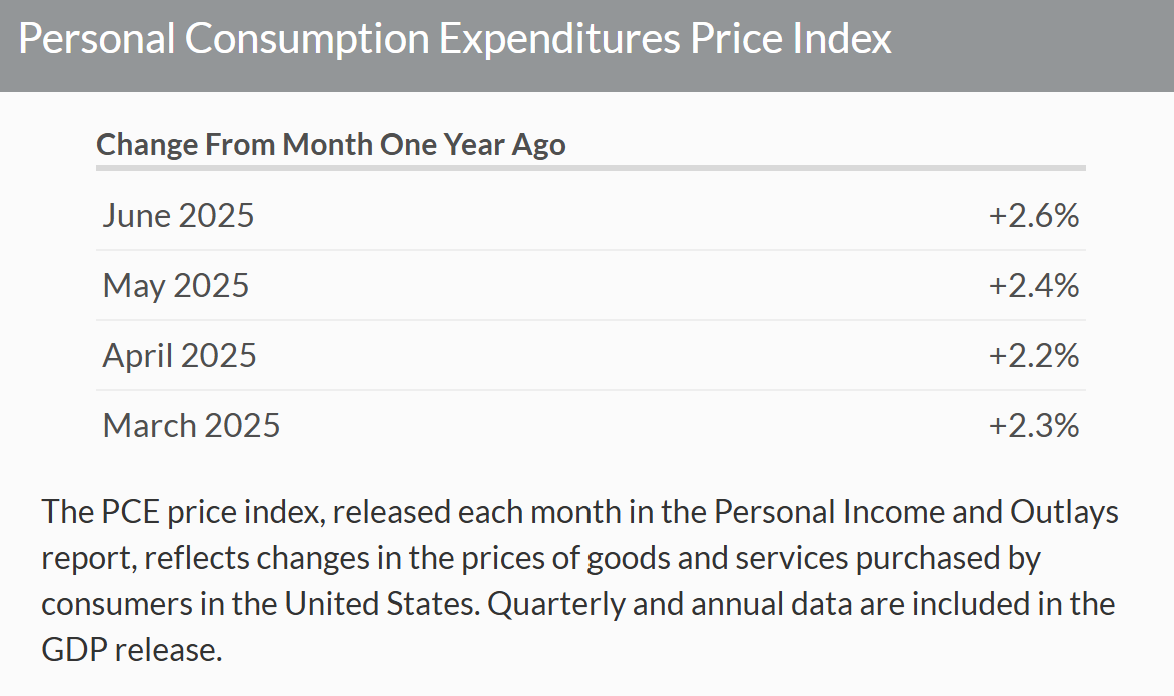

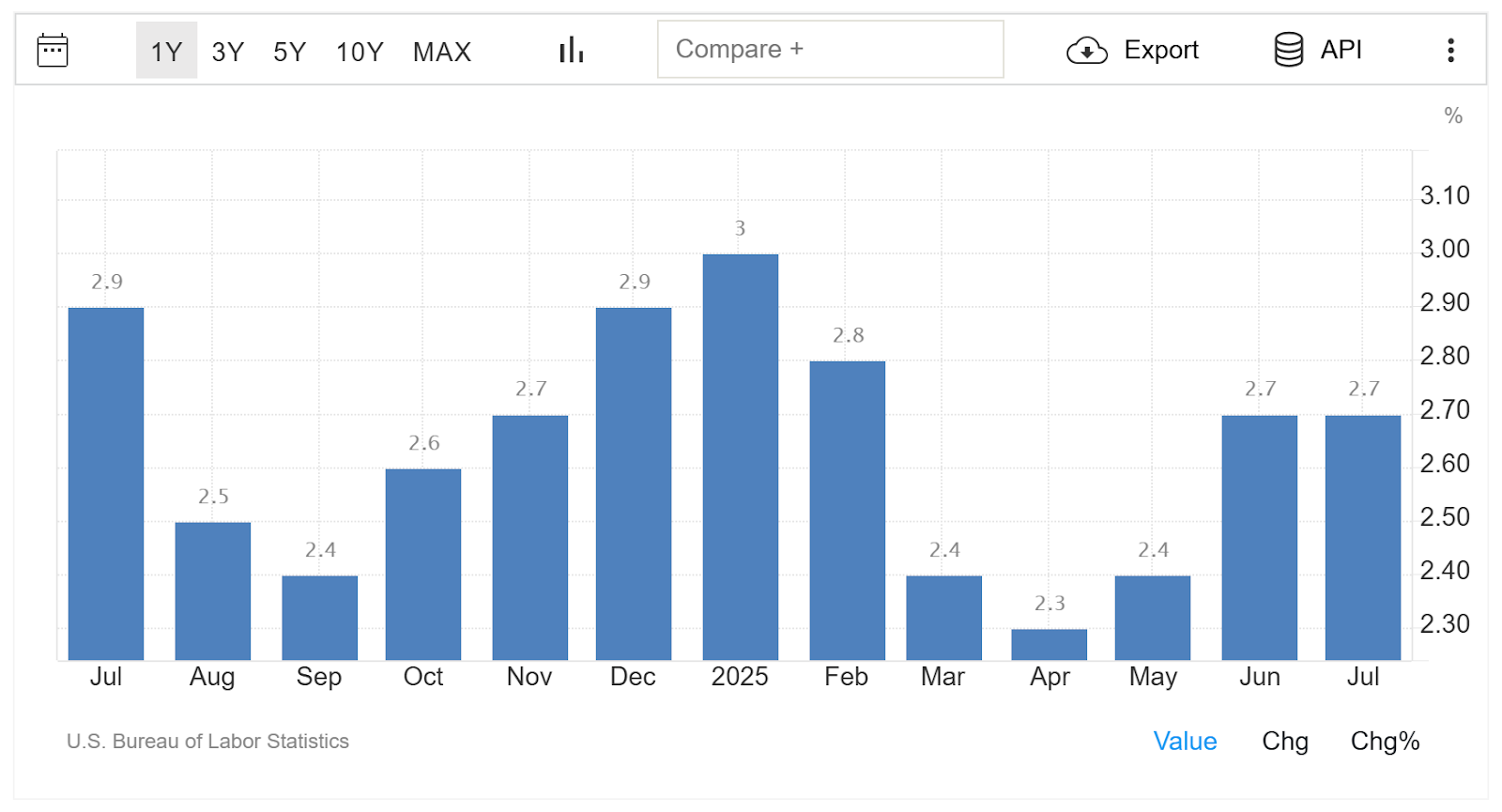

Inflation

Now let’s talk inflation. It’s still above the Fed’s 2% target. Core PCE is around 2.6%, and CPI is currently at 2.7%. Both measures are trending upward. Tariff-driven price pressures remain a concern. While most businesses haven’t yet passed tariff costs on to consumers, many are warning of price hikes in 2026 if tariffs remain in place.

Interest Rates

So what is the Fed to do? It’s walking a tightrope: lowering rates too soon could fuel inflation, but ignoring job market weakness risks tipping the economy into recession.

At Jackson Hole, Powell signaled that a rate cut in September is on the table, but, as usual, he emphasized that the decision depends on upcoming jobs data (due September 5th) and inflation data (due the following week).

Regardless of Powell’s caution, Wall Street expects a ¼-point rate cut in mid-September.

Some inside the Fed warn against assuming a cut, citing sticky inflation. But many economists believe the weakening job market is the bigger threat. Inflationary pressure, at least in the short term, could be relieved if the administration rolls back tariffs.

Recession

So, jobs are trending down, inflation is trending up, and interest rate cuts are still uncertain. What does this mean for 2026?

Many economists say a recession becomes increasingly likely if the tariff taxes stay in place. A weakening job market combined with tariff-driven price hikes is a recipe for trouble.

The NY Fed’s economist survey puts the chance of recession at about 30%, while JPMorgan Chase pegs it closer to 40%.

Recessions mean closed businesses and job losses—never good news. But that also means lower interest rates. If you’re positioned to ride out a downturn, 2026 could be a smart time for a big purchase, like a new car or home, as borrowing costs will likely fall as the economy cools.

Sources

Chair Jerome H. Powell. Monetary Policy and Fed’s Framework Review. Federal Reserve, Aug. 22, 2025. https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

Timiraos, Nick. Powell’s Rate Cut Signal Reflects Economy’s Delicate Position. Wall Street Journal, Aug. 23, 2025.

Schneider, Howard, and Saphir, Ann. Powell says Fed may need to cut rates, will proceed carefully. Reuters, Aug. 22, 2025.

Mutikani, Lucia. US labor market cracks widen as job growth hits stall speed. Reuters, Aug. 1, 2025.

Trading Economics. United States Inflation Rate. https://tradingeconomics.com/united-states/inflation-cpi

Iacurci, Greg. ‘The eye of the hurricane’: Why the US job market has soured, economists say. CNBC, Aug. 1, 2025.